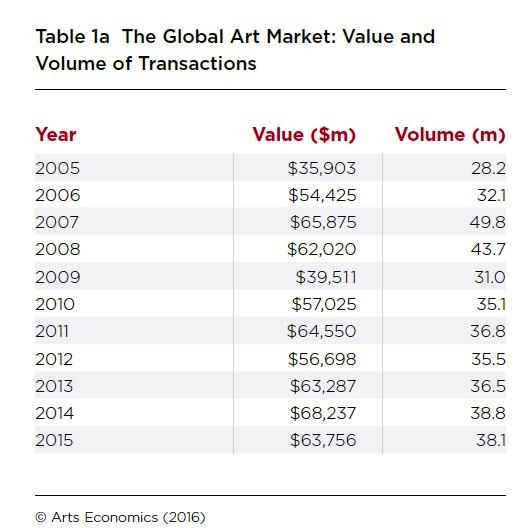

The global art market made $63.8 billion last year, but the volume of sales declined by two percent, the first decline since 2011.

The decline is largely an impact of a pull-back in the Chinese market within a broader climate of economic readjustment and an evening out of the ultra-top tier, which has spiked the market in recent years. It might be described as the inevitable adjustment we’d been awaiting.

The news was broken to the art world by cultural economist Clare McAndrew, Founder Art Economics, the Dublin-based research firm that publishes the annual TEFAF Art Report.

The report has been released annually since 2000 to coincides with the TEFAF Art Fair, held in Maastricht, Netherlands (11-20 March). It has become known as the definitive barometer to global art trade.

The 2016 report was released last week. McAndrew highlighted the divergence between the US and the rest of the market noting, ‘The US Art Market reaches highest ever level of sales while overall global market values fall.’

Works sold for over $1 million accounted for the majority of value in fine art auction sales (57%) during 2015, despite representing less than one percent of all transactions.

Read: How the art market’s million dollar distortion affects you

The report found global sales fell 7% during 2015 from $68.2bn to $63.8bn and the volume of sales declined by 2% to 38.1 million.

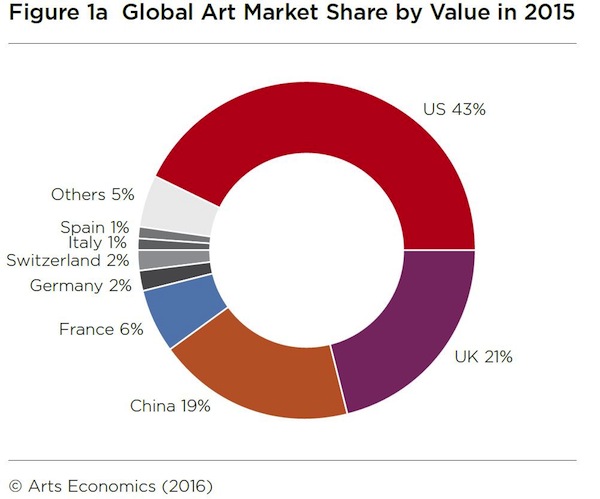

While sales fell globally, they rose in the US by 4% to their highest ever total of $27.3bn confirming its position as the global market leader, with a 43% share of total sales values.

The UK sat in second place with a 21% market share and China accounted for 19% by value

Impact of Chinese market

In recent years the Chinese market has become a formidable force in the global art trade.

While the US has consistently lead the market, from 2012-2014 China usurped the UKs position as second in line. However this year it experienced a significant decline, with sales dropping 23% to $11.8bn.

While it might sound impressive that the UK regained its position in 2015, it should be noted that its sales dropped 9% to $13.5bn, magnifying the lost ground by the Chinese market.

While the drop in market figures warns of a “cool off” in the global art market, rather it is more realistically explained by McAndrew as an inevitable adjustments. Prices have been climbing higher year-by-year over the past decade to a point where it has been impossible to maintain continued growth.

Supply also has impacted this ultra-high end market sector, and an inability to maintain volume to come off as a perceived slow down.

The greater indication is the slight drop in the number of transactions across the overall market, which fell two per cent year-on-year to 38.1 million.

What they were buying

The largest sector of the fine art auction market was Post War and Contemporary Art, which accounted for 46% of the market by value and 41% of transactions.

Despite its significant growth over the past two years, this result represented a fall year-on-year by 14% to $6.8 billion, which can also be understood as a 20% drop in the number of transactions.

Modern art remained the second largest category accounting for 30 percent of the value of sales or $4.5 billion. It also saw a drop, but just 1%. The report added that it was this collecting area where ‘the highest record prices at auction were found in 2015, including the world record prices for works by Picasso and Modigliani that both exceeded $170 million each.’

‘Sales at auction of European Old Masters showed a moderate increase of 4% by volume, although sales values fell by 33%. In contrast, private sales of European Old Masters, which made up a very important component of aggregate values, were particularly strong,’ TEFAF reported.

Showing a positive trajectory were some sectors of the decorative arts market. Chinese decorative art and antiques increased 6% year-on-year to $2.2bn, with porcelain and ceramics garnering some of the highest prices.

Despite the pull back in the Chinese market, decorative arts and antiques continue to remain an escalating market.

The TEFAF Art Market Report was presented by Dr Clare McAndrew at the fifth TEFAF Art Symposium on 11 March, entitled Informing The Art World – Speed, Needs & Globalisation.

The annual TEFAF report collates data from dealers, auction houses, industry experts, collectors and industry databases. The full report is available at www.tefaf.com