In the art world, the year has only just begun. Many commercial galleries have only recently emerged from their year-end slumber and some auction houses are yet to hold their first sales for the year.

Australia’s total art auction sales for 2012 reached just over AUD $95 million. When you consider that one painting alone, Munch’s The Scream 1895, sold for almost USD $120 million in New York last year, Australia constitutes a very small slice of the global art market pie.

The larger and more diversified overseas market enables auction houses to hold individual sales for specialist genres, ranging from Old Master Paintings to South African Art and everything else in between. The website of Sotheby’s UK outlines 35 different departments under Painting, Sculpture and Drawings, including Latin American Art and British Paintings 1550-1850. The website of Sotheby’s Australia lists just two: Australian & International Art and Aboriginal & Oceanic Art. A quick survey of the websites belonging to other major Australian auction houses reveals much the same.

In Australia, mixed category auctions are more the norm, making it hard to identify ‘hot trends’, because there is simply not a big enough sample to work with. However, we can see patterns emerging overseas, which have resonances for the local market. Here are three of the big ones:

Chinese Fine & Decorative Art

China may have dropped behind the US in terms of spending on art and antiques in 2012, but it is still an important player in the global art economy and it provides much needed highlights in an ailing decorative arts market. Decorative Arts, which encompasses furniture, porcelain and textiles, has been hit hard by changing tastes as buyers increasingly turn away from antiques, particularly the category referred to in the trade as ‘brown furniture’.

Recently, at Sotheby’s in New York, a Northern Song Dynasty bowl measuring just 13cm in diameter sold for USD $2.22 million against a pre-sale estimate of USD $200,00-300,000. While auction houses base their estimates on recent sales of comparable examples, competitive bidding from numerous interested parties can drive the final selling price far in excess of the pre-sale estimate. Cashed up buyers from countries with rapidly growing economies honing in on particular items can create a heady auction environment.

At auction, the successful buyer pays upwards of 20% on top of the hammer price (the amount the work was knocked down for in the room), an amount which is referred to as a buyer’s premium. As with other businesses, auction houses like to present their sales figures in the best possible light. They quote results which include the buyer’s premium, meaning that the figure you see reported in the press is higher than the actual selling price in the room. This is important to know if you are ever lucky enough to sell a valuable item at auction, because you will only receive the hammer price less costs. The buyer’s premium is retained by the auction house.

The sale of the above thousand-year-old Chinese bowl was made all the more interesting by the fact that it was purchased for US $3 at a garage sale in 2007. Given that porcelain buyers are deterred by even the most minor of imperfections, it must have been either very well looked after or incredibly lucky to have made its journey through history unscathed.

Runaway successes are not unknown in the auction world, particularly when a number of motivated buyers are intent on securing the same item. Sydney auctioneers, Theodore Bruce, witnessed this phenomenon at their 2012 sale in Cowra, when a small bronze Chinese Buddha, estimated at AUD $300-400, fetched AUD $90,000. The item attracted a great deal of interest from local and Chinese bidders, as did a second Chinese Buddha, which achieved AUD $60,000, also against an estimate of AUD $300-400. With the growth of illustrated online catalogues and internet bidding, it is increasingly difficult for items such these to go unnoticed, even if they are sold far away from major sale rooms. It appears that the only way to pick up a sleeper these days is at a garage sale or rubbish tip, because these are the only places which are not yet online.

Post-War Art

Much of the work presented at auction in Australia dates from the post war era, with eight of the top ten prices achieved in 2012 being attained by works from this period. While the market overseas continues to be strong for Impressionist and modern art, there is also increasing demand for works by post war artists.

One such artist is Francis Bacon, whose 1976 nude, Figure Writing Reflected in Mirror fetched almost USD $45 million at Sotheby’s New York last year. More recently, a triptych self portrait was sold in London for USD $21.6 million pounds, while Ewbank Auctions in Surrey sold a collection of six canvas fragments from the artist’s Screaming Pope series for USD $70,000. The works were discovered on the reverse of framed canvases, featuring paintings by the amateur artist, Lewis Todd. It appears that Todd received the canvases from his local art supplier, who also supplied materials to Bacon. A major example from the Screaming Pope series, Untitled (Pope) circa 1954, fetched almost USD $30 million towards the end of last year, while the record for a work by the artist was set in 2008 by a large triptych which achieved over USD $86 million.

Kitsch

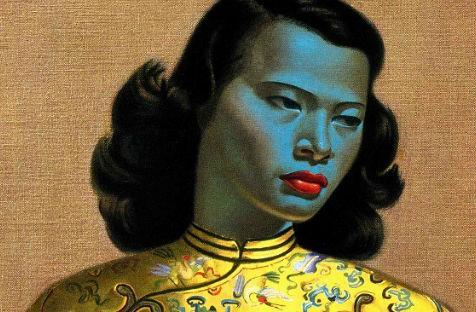

Vladimir Tretchikoff’s Chinese Girl 1951 is one of the most widely reproduced paintings in the world, with prints gracing walls in London, Cape Town and even the odd coffee shop in Surry Hills.

Although Tretchikoff has obviously captured the popular imagination, he certainly hasn’t received the adulation of critics, with Chinese Girl being dubbed ‘the Mona Lisa of Kitsch’, while the artist himself has been described as ‘a painterly Barbara Cartland’.

Recently, the original painting, from which the reproductions were taken, was sold at Bonhams of London’s South African Art auction for USD $1.5 million. Given that the painting’s American owner purchased the work for USD $2,000 in 1954, she was undoubtedly delighted with the result. This was a considerable increase from the previous high achieved in October 2012 for Portrait of Lenka (Red Jacket), which also took the art buying public by surprise, fetching GBP 337,250 pounds against an estimate of GBP 50,000-80,000.

While a retrospective of the artist’s work in South Africa a couple of years ago has no doubt helped to rehabilitate his reputation, the sale of Chinese Girl also demonstrates how important examples by known artists, which are fresh to the market, can ignite the attention of potential buyers.

While kitsch is unlikely to dominate walls of auction houses in the near future, recent auction sales of Tretchikoff’s works admirably demonstrate how less well-regarded artists and/or genres can flourish given the right conditions.

The 2013 auction season has barely begun and it remains to be seen what else will inspire the interest of the buyers, both here and overseas, during the course of the year.