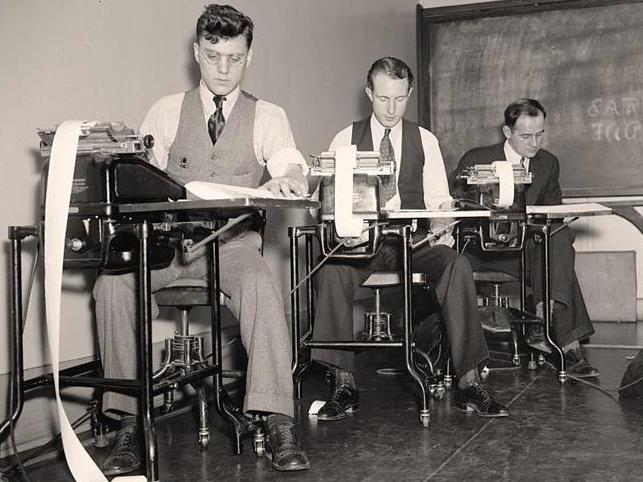

Image via oldpicture.com

Sometimes our arts practice is a business. Sometimes our arts practice is a hobby. Occasionally our arts business is a hobby masquerading as a business.

There are a few ways to tell which of these categories most accurately describes your arts practice.

Is it viable?

Arts practices are not about profitability. They’re about viability. In the early years many small businesses lose money while they’re building up reputation and customers. That’s perfectly normal. But in moving from an arts hobby to an arts business you have to consider not just whether a business is profitable but whether it could ever be viable.

Ask yourself these questions:

- Do you still want to do it year after year? Is it still something you’ll still be passionate about? Will you still want to pour your time, love and resources into it?

- Is there a market for it? Does anybody want it? Does anybody like it? Are there people who are willing to give me their time and money to receive my art?

If you want to do it and there are customers, you have a viable business even though it might be several years before you have a profitable business.

If there’s no market, it may be time to rethink or accept that it’s a hobby.

If there’s a market but you don’t want to do it anymore, it may be time to look towards doing something which you’ll enjoy more.

Have you tracked the numbers?

If you are unable or unwilling to count what your art costs you or what it makes, you are not in business. To move beyond a hobby, you need to start tracking some numbers, and become comfortable talking about them. If you can’t talk the numbers, you aren’t really in business because you can’t manage what you can’t measure.

As you move your practice from a hobby to a business you need to become conscious of what it costs to produce the product or service and how much money comes in from the product or service. Tracking the numbers doesn’t have to be difficult or complicated. It can be as simple as getting an exercise book and on the left page writing down money coming in – any sales, contracts, gigs. On the right side, write down money going out – what you’ve spent to create your product or deliver your service. At the end of each month add up the page.

Don’t worry if the numbers don’t look profitable yet. The ATO will let you have a loss for three to five years because they understand that you’re trying to build your business. In the early days of building a business you’re often going to spend more money than you’re going to make. Also in the early years you’re likely to be giving away products and services to build your client base. It’s fine to do this, but you have to know and be conscious of the numbers.

Are you tracking your customers?

A successful business is built on repeat customers – you have to have a method of tracking customers so that you can focus on the people who come back. Getting the first sale is difficult, getting the second or third sale is much easier if you have the data. Creating a database doesn’t have to be a complicated expensive piece of software, like a CRM (Customer Relationship Manager).

Any list is fine – it just has to be something that you can download, sort and make notes in. It can be on an excel spreadsheet, a table in Word. It’s not useful if it’s just signatures in a guest book – take the time to type it into some kind of form, table or database. The important part is that you begin to recognize and build relationships with repeat customers.